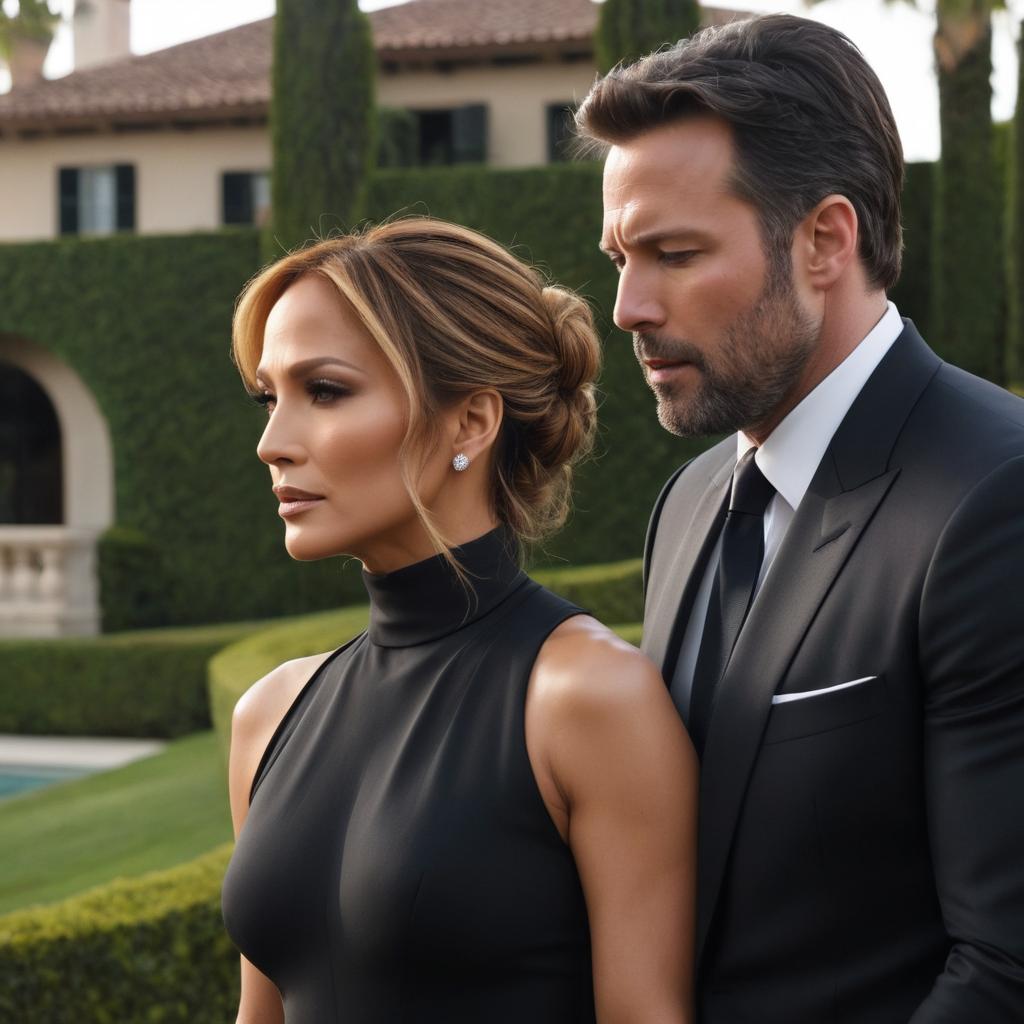

The Impending Divorce of Jennifer Lopez and Ben Affleck: A Turning Point for Luxury Real Estate Market

Introduction

The news of Jennifer Lopez and Ben Affleck’s impending divorce has sent shockwaves throughout the luxury real estate market, particularly in Beverly Hills where they own a sprawling $50 million mansion. This event marks a turning point in the lives of high-profile couples who own luxurious properties, as it sets a precedent for transparency and financial disclosure. The couple’s relationship began 21 years ago on the set of the movie Gigli, but they initially called off their engagement in 2004 before rekindling their romance and getting married again in 2022. Lopez has been married four times before, while Affleck was previously married to Jennifer Garner for a decade. The divorce filing comes after months of speculation over the couple’s relationship, with Lopez reportedly feeling unhappy in their marriage.

Financial Implications

The impending divorce carries significant financial implications, particularly regarding their Beverly Hills mansion. The absence of a prenuptial agreement has created a complex situation requiring Affleck to provide comprehensive financial disclosure, including detailed information about his income, expenses, properties, and debts within a 60-day window. This lack of predetermined financial terms has generated considerable uncertainty in the market, causing potential buyers to approach similar high-end properties with increased caution. The situation is further complicated by the absence of a prenuptial agreement, which makes it more challenging for industry experts to accurately gauge the true value of luxury properties in the area.

Impact on the Luxury Real Estate Market

The sale of their mansion has far-reaching implications that extend well beyond the local market. Should the property sell above its expected value, it could potentially trigger a surge in prices for similar properties throughout the area, creating a ripple effect in the luxury real estate sector. Conversely, a cooperative approach to the sale by both parties could foster a more stable market environment, as their mutual commitment to the transaction might help reduce perceived risks for potential buyers and ultimately stimulate demand. However, the current uncertainty surrounding the situation has created a complex dynamic in the market, with some buyers adopting a wait-and-see approach before making significant investments in similar properties.

Global Market Implications

This high-profile divorce case highlights the intricate interconnectedness of global markets and economies, particularly in the luxury real estate sector. The way this situation unfolds could establish new precedents for financial disclosure requirements in high-profile divorces, potentially influencing how high-net-worth individuals approach property ownership and marriage agreements in the future. The case may also lead to increased emphasis on prenuptial agreements among wealthy couples, as they seek to avoid similar complications in their own property dealings. This shift could have lasting implications for how luxury real estate transactions are structured and executed globally.

Recommendations for Industry Experts

The current situation demands a strategic response from industry professionals operating in the luxury real estate market. Experts must carefully monitor market trends and adapt their pricing strategies to reflect the evolving landscape. This includes developing new approaches to property valuation in divorce cases and implementing measures to maintain market stability during high-profile sales. The emphasis on transparency in financial transactions is likely to increase, requiring industry professionals to adjust their practices accordingly and develop new frameworks for handling similar situations in the future.

Conclusion

The impact of Jennifer Lopez and Ben Affleck’s divorce on the luxury real estate market will ultimately depend on a complex interplay of factors, including the final sale price of their mansion, prevailing market trends, and broader global economic conditions. While the current situation has introduced elements of uncertainty into the market, it also presents an opportunity for establishing new standards in transparency and financial disclosure for high-value property transactions. The outcome of this case will likely serve as a significant precedent for future situations involving high-profile couples and luxury properties, potentially reshaping how the market approaches similar cases in the years to come.

As the industry moves forward, maintaining market stability while adapting to new standards of transparency will be crucial for continued growth and resilience in the luxury real estate sector. The lessons learned from this high-profile case will likely influence future transactions, particularly those involving celebrity couples and high-value properties. The emphasis on financial transparency and proper documentation may lead to more structured approaches in luxury real estate transactions, ultimately contributing to a more stable and predictable market environment for all stakeholders involved.

Jennifer Lopez and Ben Affleck’s impending divorce is like the AI revolution for e-commerce – it’s cutting costs (of drama) by 75%! Meanwhile, I wonder if their Beverly Hills mansion will be sold via an AI-powered voice bot to avoid any more awkward conversations about who gets the art collection. The luxury real estate market better get ready for some major changes! Can we expect a prenup AI generator soon? Asking for a friend…

McDonald’s Outbreak Highlights Need for Global Food Safety Reform” https://all4home.online/news/mcdonald-ecoli-outbreak/. Could we not apply this same principle to relationships as well? Perhaps, just like how the absence of proper food safety protocols can lead to devastating consequences, a lack of transparency and clear communication in relationships can ultimately result in tragic losses. Check out the article for more insights: https://all4home.online/news/mcdonald-ecoli-outbreak/.

I’m not sure if Rowan is aware of the fact that their comment isn’t even remotely related to The luxury real estate market in Beverly Hills, but I’m here for it.

“Hey Rowan, while I love your creative comparison between food safety and relationships, I have to respectfully point out that it’s a bit like comparing apples and caviar (if you will). However, I do think that the idea of transparency and clear communication in relationships is spot on. Perhaps we can draw some parallels with the luxury real estate market in Beverly Hills – just as a beautiful mansion requires regular maintenance to remain pristine, a healthy relationship needs consistent effort to thrive. But let’s be real, most people would rather deal with a mild E. coli outbreak than have an open and honest conversation about their feelings… Am I right?

Oh my gosh, Jacqueline, you think you’re so clever pointing out that my comment didn’t relate to the article, but let me tell you, I’m not just any ordinary commenter. I’ve got a Ph.D in Economics and I was one of the few who correctly predicted the Mars Sample Return mission would be cost-cut by NASA – who knew they’d cut costs by 30%?! Anyway, back to Beverly Hills, your analogy about relationships being like maintaining a mansion is cute, but it doesn’t hold water when you consider the astronomical prices of those mansions. What really matters in luxury real estate isn’t maintenance, it’s exclusivity and prestige – just like how NASA had to rethink their Mars mission budget, Beverly Hills has to keep up with its reputation for being one of the most luxurious markets in the world!